A few of these new companies have taken on the task of updating invoice financing. If you’re a business owner who uses invoices, waiting around for your B2B customers to dish out the dough can be a huge drag on your resources. And these days, companies are taking longer than ever to do just that. Learn how trade credit insurance empowers Stena Metal, a Swedish metal recycling company, to run a sustainable business in a high-risk industry.

Pros and Cons of Invoice Financing for Small Business

- Google Pay lets customers store their payment information, like their credit card, in the Google Pay wallet.

- In this way, invoice financing is a great funding option for B2B and service-based businesses—as it alleviates cash flow problems due to unpaid customer invoices.

- Cash App is an especially handy option for one-man shops and owner-operators because it’s so simple.

- In addition, the cost means you’re essentially missing out on the full revenues of customer invoices, impacting profit margins.

- Qualifying for invoice financing usually requires businesses to have a track record of issuing invoices to creditworthy customers.

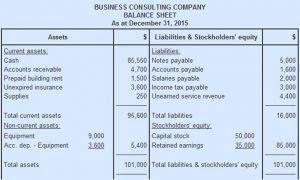

- The financing company may advance around 80-90% of the invoice value upfront, minus a fee (discount rate), and hold the remaining amount as a reserve.

- Let’s dive into what you need to know about invoice financing, including what it is, why you might use it, and its advantages and drawbacks.

This makes it easier for companies with bad credit to qualify and secure funding. Both invoice discounting and factoring are potential solutions to dealing with slow cash flow. However, invoice financing there are some crucial differences in the way the deals are structured. Many invoice financing companies can make you an offer and transfer you funds within a few days.

- Because your invoices serve as collateral, invoice financing can be easier to qualify for than other small-business loans, although borrowing costs can be higher.

- As with all types of business financing, your credit rating helps providers evaluate your creditworthiness.

- These include bank transfers and digital wallet payments, as well as PayPal and Stripe.

- Now, let’s take a look at the different types of invoice financing.

- Both invoices discounting and factoring are potential solutions to dealing with slow cash flow.

- Some will be less concerned with that and more concerned with the number of outstanding invoices.

The Best Invoice Financing Options

The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities. You’ll then need to pay a weekly percentage based on how long you take to pay. Lenders routinely charge around 1% per week, but actual costs vary wildly. Assuming you’ve been approved, the lender will allow you to borrow a percentage of your invoices’ value, typically 85% to 95%. Most companies will have an online application form that you simply need to fill out and send off for approval. MCAs usually charge a factor rate that’s multiplied by the entire amount borrowed.

Invoice financing for small businesses with BILL

Beyond the financial implications, invoice fraud can tarnish a company’s reputation and, in turn, affect the level of trust between organizations and their vendors. The lending institution will advance a certain percentage of unpaid sales invoices. You will receive the remaining amount https://www.bookstime.com/ minus the financing charges when the customer repays on maturity. However, invoice financing can have higher interest rates and is primarily beneficial for B2B businesses. Businesses also need to consider that lenders typically finance between 80%-90% of the invoice value.

It’s easy to set up payment forms and send customers the information they need after purchase. Online payments include any transactions that happen over the internet. These include bank transfers and digital wallet payments, as well as PayPal and Stripe. Paying online is easy for customers and easy for businesses, allowing for quick and secure processing. Invoice financing in reality promotes success for businesses allowing them to maintain a steady cash flow in the event of long invoice payment terms.